Decoding Mortgage Loans in 2024: How Americans Buy Their Dream Homes 🏠💳

Loans specifically designed to help individuals buy property.

In 2024, the mortgage market is evolving with rising interest rates, tighter lending criteria, and innovative financing options.

If you’re curious about how

Americans finance their homes, buckle up!

Here’s everything you need to know.

What Is a Mortgage? 📜💰

A mortgage is a type of loan where a bank or lender provides money to purchase a property. In exchange, the property serves as collateral until the loan is fully paid off.

It’s not just about borrowing money

it’s about planning your finances for decades to co.me.

Key Terms to Know

- Principal: The original amount borrowed.

- Interest: The cost of borrowing money, typically expressed as a percentage.

- Term: The duration of the loan, usually 15 to 30 years.

- Down Payment: An upfront payment made when buying a home, usually 5%-20% of the property’s price.

Types of Mortgages in the U.S. 🏡⚖️

Mortgages aren’t one-size-fits-all. Here are the most common types Americans choose from:

1. Fixed-Rate Mortgages (FRMs) 🔒

With an FRM, your interest rate stays the same throughout the loan term.

- Pros: Predictable payments, stability over time.

- Cons: Higher initial rates compared to adjustable-rate loans.

2. Adjustable-Rate Mortgages (ARMs) 📈📉

ARMs start with a lower interest rate for a set period (e.g., 5 years),

after which the rate adjusts annually based on the market.

- Pros: Lower initial costs, ideal for short-term buyers.

- Cons: Payments can skyrocket if interest rates rise.

3. FHA Loans 🏠💵

Backed by the Federal Housing Administration,

FHA loans are designed for first-time buyers and those with lower credit scores.

- Pros: Low down payments (as little as 3.5%), easier qualification.

- Cons: Mortgage insurance premiums (MIP) increase overall costs.

4. VA Loans 🎖️

Exclusively for veterans, active-duty service members, and their families, VA loans offer zero down payment and no private mortgage insurance (PMI).

- Pros: Low costs, favorable terms.

- Cons: Available only to eligible military personnel.

5. Jumbo Loans 💎

If you’re buying a high-value home, a jumbo loan covers amounts that exceed conventional loan limits.

- Pros: Access to luxury properties.

- Cons: Stricter credit and income requirements.

Current Mortgage Trends in 2024 📊🔮

https://themortgagereports.com/61853/30-year-mortgage-rates-chart

1. Rising Interest Rates 📈

Interest rates have been climbing steadily, with the average 30-year fixed-rate mortgage hovering around 7%-8%.

This makes borrowing more expensive and pushes buyers to consider alternative financing options.

2. Creative Financing Options 🤔💡

In response to high rates, lenders are offering innovative products like buydown mortgages, which start with lower payments for the first few years.

Another trend?

Co-buying, where friends or family pool resources to purchase a home together.

3. Stricter Lending Requirements 🔐

Lenders are tightening credit score and income requirements to minimize risks.

Applicants with scores under 620 may struggle to qualify, while those with excellent credit (740 and above) enjoy the best rates.

4. Increased Popularity of 15-Year Mortgages 🕒💨

Although monthly payments are higher,

15-year loans save borrowers thousands in interest and allow them to build equity faster—a tempting option in today’s market.

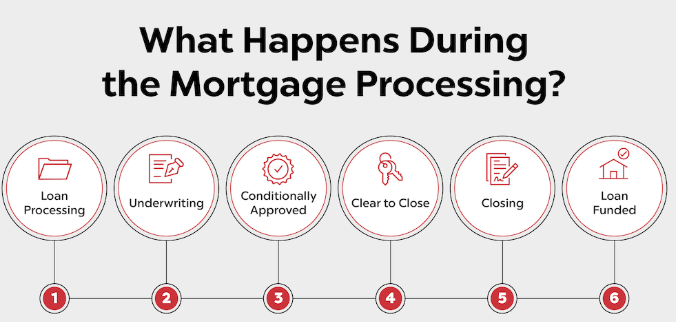

The Mortgage Process: Step-by-Step 🚪📋

Here’s how Americans typically secure a mortgage:

1. Pre-Approval ✅

Before house-hunting, buyers get pre-approved by a lender, which involves a credit check and verification of income.

This step shows sellers that the buyer is serious.

2. Finding a Home 🏡💖

Once pre-approved, buyers shop for their dream home.

Upon finding the right one, they make an offer.

3. Loan Application 📝

The formal loan application includes providing detailed financial documentation.

4. Underwriting 🔍

During underwriting, the lender evaluates the borrower’s ability to repay the loan.

This is when the loan is approved or denied.

5. Closing 🔑

At closing, the buyer signs all necessary documents, pays closing costs, and officially becomes a homeowner.

Challenges in 2024 ⚠️😬

Affordability Crisis 🏚️

With home prices and interest rates rising, many Americans are being priced out of the market.

The average mortgage payment now takes up over 30% of household income—a level considered unaffordable.

Student Loan Debt 🎓💸

Many millennials and Gen Z buyers face the double burden of student loans and mortgage payments, making it harder to save for a down payment.

Housing Supply Issues 🚧

A shortage of affordable homes keeps demand high, especially in popular cities like Austin, Seattle, and Miami.

Tips for Mortgage Success 📝💡

- Boost Your Credit Score: Pay off debts and avoid taking on new credit before applying.

- Save for a Bigger Down Payment: A larger down payment reduces monthly costs and avoids PMI.

- Shop Around: Don’t settle for the first lender—compare rates and terms.

- Consider Assistance Programs: Many states offer grants or low-interest loans for first-time buyers.

The Future of Mortgages 🏦🔮

As technology advances, expect the mortgage process to become faster and more streamlined.

Online platforms already allow buyers to pre-qualify, compare rates, and even close loans digitally.

But with affordability challenges looming, policymakers may need to step in to make homeownership attainable for more Americans.

Core Takeaway: Mortgages are the gateway to homeownership in the U.S.,

but rising rates and changing trends in 2024 mean buyers need to be more strategic than ever. Understanding your options and planning ahead is the key to making your dream home a reality.

#Mortgage2024 #BuyingAHome #USHousingMarket #MortgageTips #Homeownership #AmericanDream

No comments:

Post a Comment