Regional Home Prices in the U.S. (2024): Where Can You Afford to Buy? 🏡📊

Are you dreaming of buying a home in the United States but unsure where to start? 🏠 Whether you’re looking at the sunny coasts of California, the sprawling suburbs of Texas, or the bustling streets of New York, regional home prices vary drastically. In 2024, the housing market remains a hot topic, with some areas becoming more affordable while others continue to skyrocket. Let’s break down home prices by region and explore what’s driving these trends.

The Big Picture: U.S. Median Home Price 💵🇺🇸

As of December 2024, the national median home price is approximately $420,000. While this figure offers a baseline, it’s crucial to understand how local markets can deviate significantly.

West Coast: The Pricey Paradise 🌴🏖️

The West Coast continues to boast some of the highest home prices in the country. Cities like San Francisco, Los Angeles, and Seattle remain popular but expensive choices.

- Key Drivers: High demand, limited supply, and thriving tech industries.

- Hotspot: San Jose, CA, where the average home price exceeds $1.2 million.

Affordable Alternatives:

- Move inland! Cities like Sacramento offer relative affordability at an average price of $500,000.

Northeast: Historical Charm, Modern Prices 🏛️🍂

The Northeast is home to iconic cities like New York, Boston, and Philadelphia.

- Key Drivers: Historical significance, dense populations, and strong job markets.

- Hotspot: New York City, where the average home price hovers around $750,000.

Affordable Alternatives:

- Check out smaller cities like Scranton, PA, with average prices around $250,000.

Midwest: The Affordable Heartland 🌽🏡

The Midwest is the most affordable region, making it attractive for first-time buyers and remote workers.

Cities like Detroit and Cleveland offer bargain prices compared to coastal markets.

- Key Drivers: Lower population density, slower economic growth.

- Hotspot: Chicago, where home prices average $350,000.

Super Affordable Spot:

- Indianapolis, IN, where homes average just $250,000!

South: Growth and Opportunity 🌞🏗️

The Southern states are experiencing a population boom, driven by affordability and job opportunities.

States like Texas, Florida, and Georgia dominate this region.

- Key Drivers: Business-friendly environments, lower taxes, and warm climates.

- Hotspot: Austin, TX, with home prices averaging $600,000.

Budget-Friendly Pick:

- San Antonio, TX, with prices averaging around $300,000.

Trends Shaping the Market in 2024 🔍📈

1. Migration Patterns 🛫🌎

- Remote Work Exodus: Many workers are leaving expensive cities for more affordable regions.

- Southern Growth: Texas and Florida are magnets for newcomers.

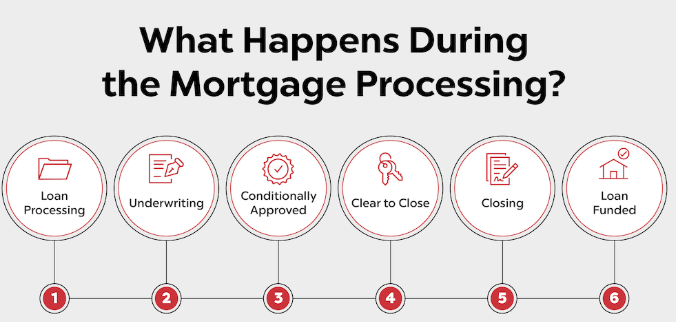

2. Interest Rates 📉💰

With interest rates hovering around 7%-8%, higher mortgage costs are deterring some buyers, cooling the market slightly in pricier areas.

3. Inventory Shortages 🚪💔

Limited housing supply is driving up prices in high-demand regions.

Where Should You Buy in 2024? 🤔💡

Choosing the right region depends on your priorities:

- Affordability: Head to the Midwest or smaller Southern cities.

- Career Growth: Stick to the West Coast or Northeast hubs.

- Lifestyle: Consider the South for warm weather and lower costs.

Core Takeaway: The U.S. housing market remains dynamic and diverse, with options for every lifestyle and budget.

Regional trends offer opportunities, whether you’re seeking urban excitement or suburban tranquility.

#HomePrices2024 #USRealEstate #HousingMarketTrends #RegionalPrices #AmericanHomes #AffordableLiving